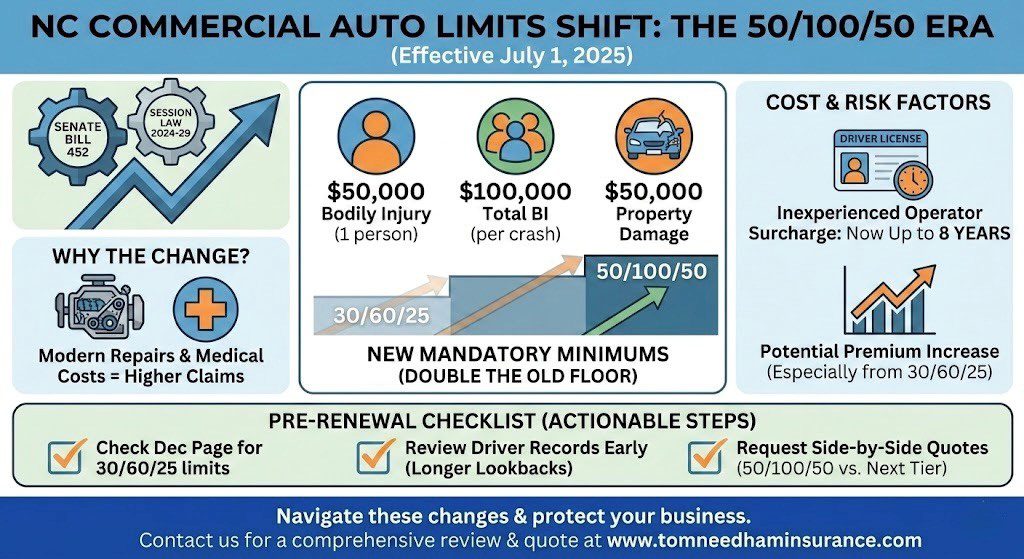

The shift to North Carolina 50/100/50 insurance limits marks a significant change for commercial auto policies. The new limits have been valid since July 1, 2025. The update is tied to a wider set of reforms, including the Senate Bill 452 insurance changes, that also adjust parts of the rating system. If your business uses vehicles, even one, the new minimums can change your renewal and your risk profile.

What does “50/100/50” mean

“50/100/50” is split-limit shorthand:

- $50,000 for bodily injury to one person,

- $100,000 total bodily injury per crash, and

- $50,000 for property damage

North Carolina’s Department of Insurance lists these as the new minimum limits for policies new or renewed on or after July 1, 2025.

Many commercial auto insurance policies already exceed the minimum because contracts require it. The firms most likely to see a direct adjustment are small operators that kept the old 30/60/25 minimums.

Why the state raised the floor

The old minimums were built for a cheaper era. Repairs on modern vehicles can involve costly parts and specialized labor.

Injury claims can outgrow $30,000 quickly once emergency care becomes ongoing treatment. Higher minimums reduce the odds that a claim pushes past coverage and lands on the business owner personally.

The regulator has been clear about the trade-off: when a policy renews into higher mandatory limits, premiums can increase.

Impact of Session Law 2024-29 on NC businesses

Session laws connected to the reform set July 1, 2025 as the trigger for new or renewed policies. For commercial accounts, that means your renewal cycle decides when the change hits.

It also raises the cost of a lapse. North Carolina requires continuous liability insurance for registered vehicles.

The DMV warns that canceling coverage before surrendering a plate can lead to civil penalties that escalate with prior lapses. For a work vehicle, downtime while you restore registration can cost more than the premium increase.

What it can cost you

There’s no single statewide commercial rate increase figure because pricing depends on vehicle type, territory, driver history, and losses. Still, two pressures are predictable.

- First, if you were insured at 30/60/25, renewal after July 1, 2025 forces a move up to 50/100/50. That usually raises the liability portion of the premium, though it does not automatically double the total bill.

- Second, the same reform package changes parts of the rating system, so a renewal can reflect more than limits alone.

A practical step is to request side-by-side pricing at 50/100/50 and at the next tier up (often $100,000/$300,000). Higher limits can be a small extra spend compared with the cost of a serious claim.

Inexperienced operator surcharges for NC commercial drivers

Beginning July 1, 2025, the inexperienced operator surcharge expands for drivers first licensed on or after that date and can apply for up to eight years of driving experience, not three. For businesses that hire new drivers, that change can matter as much as the new liability minimums.

North Carolina also extends some penalty timelines: certain convictions worth four or more insurance points can trigger a surcharge for five years, and the lookback period for certain minor speeding convictions and Prayers for Judgment Continued can increase to five years for events after July 1, 2025.

A quick pre-renewal checklist

- Pull your declarations page and identify any vehicles at 30/60/25.

- Review who drives each unit and check motor vehicle records early.

- Keep certificates current for partners, and confirm that employee errands count as business use.

Frequently Asked Questions

- How much did NC commercial auto insurance rates go up in 2025?

There isn’t one statewide number. Premium changes depend on limits, vehicles, drivers, territory, and losses, and many businesses see the shift at renewal overall.

- Does my small business need to update its auto policy for the new NC limits?

Yes if the commercial auto insurance for small business is issued or renewed on or after July 1, 2025. Many insurers adjust limits at renewal, but confirm before issuing certificates.

- What happens if my NC commercial policy doesn’t meet 50/100/50 requirements?

A renewed policy after July 1, 2025 should not be written below the minimums. If coverage lapses, the DMV can assess civil penalties and registration issues can follow.

- How do the new 5-year lookback periods affect my commercial insurance premiums in NC?

For certain minor speeding convictions and PJCs after July 1, 2025, insurers can use a five-year lookback instead of three, which can keep premium effects in play longer.